The Corvus Solution

Identify, reduce, and transfer risk

The insurance policy is just one component of our cyber risk solution. In addition to tailored Cyber or Tech E&O coverage, every Corvus policyholder gets precision intelligence on the latest threats, on-demand access to cyber advisory services, and the assistance of an in-house claims team that specializes in cyber incidents.

Testimonial

“...one of my favorite things about working with Corvus is

the continued service...”

In addition to their incredible responsiveness, market knowledge and

underwriting skill, one of my favorite things about working with Corvus is the

continued service throughout the policy year that they afford to their clients.

Robert Di Rico • Broker, ARC Excess & Surplus, LLC

How it works

Expert guidance. Unparalleled service.

Cyber underwriting

Our experienced Cyber and Tech E&O underwriters work hand-in-hand with brokers to tailor each quote and find creative solutions to complex risks —providing fast quotes and customized coverage.

Always-on threat protection

Every Corvus policy includes unlimited consultations with our in-house Risk Advisors, and critical threat alerts are sent to policyholders and brokers within hours of discovery, not days. Policyholders begin with an introductory call with a Cyber Risk Advisor, who can help with account setup on the Policyholder Dashboard, their access point to continuous security monitoring data and threat intelligence.

Dedicated claims support

We’re the policyholder’s guide through the entire breach response and claims process. We assign a dedicated claims manager and a team of cyber experts tailored to each case who will help expedite recovery.

Easier cyber renewals for every account

Brokers working with Corvus can reduce their time on renewals thanks to a cyber renewal process that requires no application for most accounts and provides a tailored application with just a few questions for the rest.

Please come back later for the transcript.

Precision intelligence

Superior data. Reduced risk

By identifying relevant threats faster, we help companies take the right actions to respond to risk.

The public web

DNS records

Email tools

Web applications and servers1

Third-party service providers2

Threat intelligence & claims

Compromised assets

Breach database

Detailed data from 100,000+ cyber incidents

1 Web applications include e-commerce platforms, content management systems, and servers

2 Third-party service providers, including cloud and SaaS platforms

Risk dashboard

A platform made to manage cyber risk

The Cyber Risk Dashboard simplifies risk management — providing real-time visibility into your security posture, emerging threats, security recommendations, and claims in one intuitive platform.

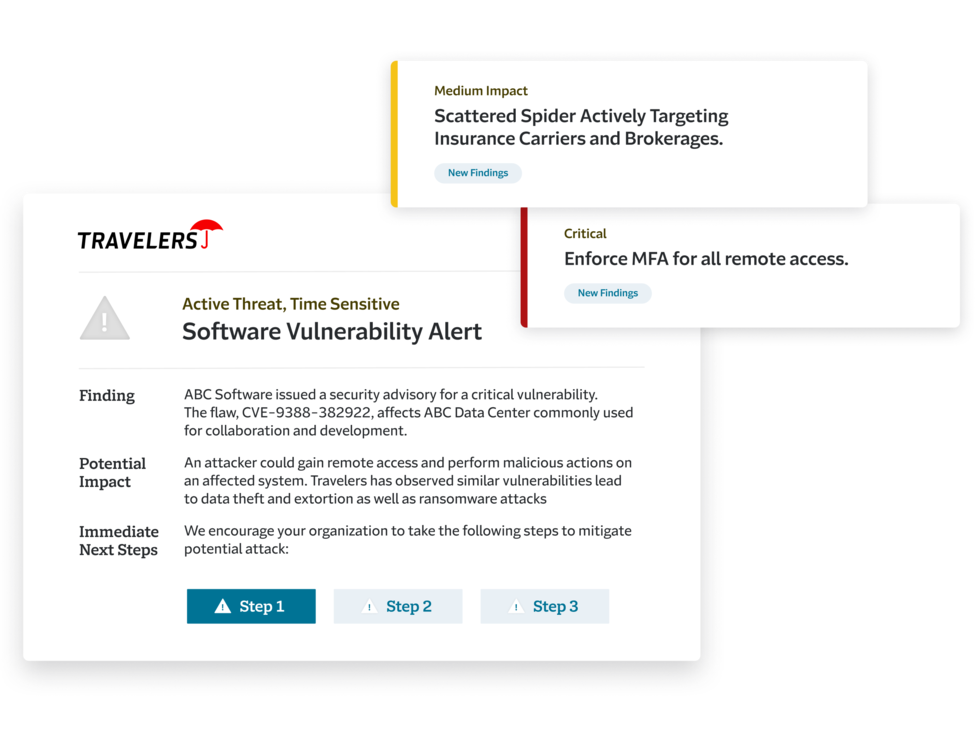

Personalized threat alerts

Access real-time alerts on emerging threats, tailored to your business. Alerts are sent an average of 15 days before exploit — providing more time to take action.

Cybersecurity recommendations

Our recommendations are driven by data gathered about the policyholder’s specific security situation, and prioritized by level of impact.

Trusted vendor marketplace

Policyholders can find the best security vendor for their business — and their budget — with our marketplace of trusted independent vendors.

Policy and claims documents

Keep track of your policy and any claims with easy access to documents and status information.

Frequently asked questions

Your cyber insurance provider is an important partner in mitigating security threats. Every Corvus policy includes access to Travelers Cyber Risk Services, the only cyber risk mitigation solution proven to reduce risk. Policyholders engaged with Cyber Risk Services have experienced up to a 20% reduction in the frequency and cost of cyber breaches. Policyholders also gain access to unlimited consultations with cyber experts, real-time intelligence on emerging threats, and easy-to-use tools to manage security risks.

Our Smart Cyber Insurance® policy covers losses resulting from a security breach or cyber crime event, including: first-party losses, or losses suffered by your company (for example, income loss or digital asset loss) and third-party losses (amounts that your company is legally obligated to pay to others).

Contact your commercial insurance broker and ask them about cyber liability coverage. Corvus’s offerings are available via select appointed agencies around the country. Our expert cyber underwriters work hand-in-hand with brokers to provide fast, accurate, and fully customized cyber insurance quotes.