Data-Driven Quotes and Cyber Coverage Built for Your Clients

Find the right policy for your clients, with customized quotes powered by our expert team and intelligent cyber insurance underwriting platform.

Please come back later for the transcript.

Regional underwriting leadership

An expert team: Your partners in cyber risk

We hire the best minds in cyber, so you can count on highly informed and responsive underwriting. If you need additional guidance during the underwriting process, our cyber risk advisors and claims team are available for on-demand consultations.

Daniel Toutoungi

VP, Northeast Region

Amanda Stantzos

VP, Midwest Region

Peter Hannapel

VP, Southeast Region

Testimonial

“...one of my favorite things about working with Corvus is

the continued service...”

In addition to their incredible responsiveness, market knowledge and

underwriting skill, one of my favorite things about working with Corvus is the

continued service throughout the policy year that they afford to their clients.

Robert Di Rico • Broker, ARC Excess & Surplus, LLC

Collaborative and customized

Our expert underwriters are dedicated to helping more businesses become insurable. We’ll work with you to tailor each quote and find creative solutions to complex risks driven by cyber threats — providing fast, accurate, and fully customized cyber insurance quotes for your clients.

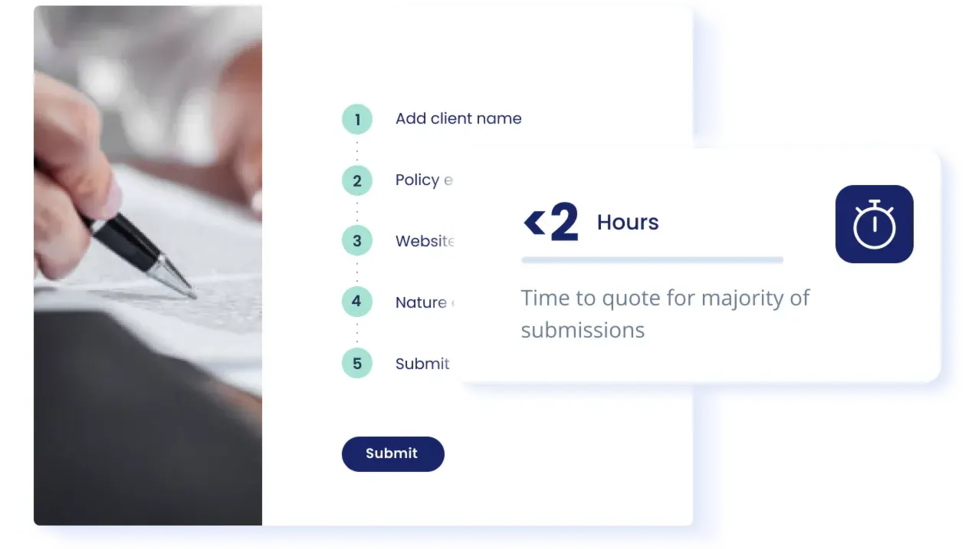

Rapid turnaround

We leverage our industry-leading data to deliver quotes quickly. Get a quote in under two hours for most submissions, or an autoquote in less than a minute for eligible risks. If you have any questions along the way or need help with a unique case, our cyber underwriting team is here to help.

to receive an autoquote for eligible businesses

to submit renewals for eligible small-to-midsized businesses

time to quote for majority of submissions

Risk NavigatorTM

Powered by the modern underwriting platform

Built by cyber underwriters, for cyber underwriters, Corvus Risk NavigatorTM is intelligent underwriting technology designed to accelerate quoting and extend insurability to more businesses.

Greater accuracy

Cyber threats change constantly. Corvus Risk NavigatorTM keeps pace, adjusting underwriting standards and pricing to reflect the current reality of cyber risk based on the latest firmographics, threat intelligence, claims, and benchmark data.

Greater transparency

Powered by insights from Corvus Risk NavigatorTM, our quotes include detailed explanations about risk scores, limits and sub-limits, and subjectivities to help policyholders understand pricing and what to do to improve security controls.

Greater speed

Corvus Risk NavigatorTM expedites quoting and enhances the speed of the cyber underwriting process. We provide quotes in under two hours for most submissions and auto quotes in less than a minute for eligible businesses.

Frequently asked questions

Our Smart Cyber Insurance® policy covers losses resulting from cyber attacks, including: first-party losses, or losses suffered by your company (for example, income loss or digital asset loss) and third-party losses (amounts which your company is legally obligated to pay to others).

We hire the best minds in cyber, so you can count on highly informed and responsive underwriting. From submission to bind, our expert underwriters are dedicated to extending insurability to more businesses. We work with cyber insurance brokers to tailor each quote and find creative solutions to complex risks — providing fast, accurate, and fully customized quotes to help protect businesses.

If you need additional guidance during the cyber underwriting process, our risk advisors and claims team are available for on-demand consultations.

During the policy period, policyholders and brokers can access on-demand support and risk advisory services. Whether they’re looking for insights on the latest cyber incidents or help mitigating security threats, our in-house team of expert underwriters, cyber risk advisors, and claims specialists are just a phone call or email away.

Corvus collaborates with the top cyber insurance brokers in the market, including both wholesale brokers and retail brokers. These partnerships emphasize expertise in cyber risk management, ensuring clients receive tailored coverage that addresses evolving digital threats and cyber exposure such as social engineering fraud, business email compromise, and phishing attacks. Corvus values partnerships with brokers committed to client education, creating a network that enhances the accessibility and effectiveness of cyber insurance solutions across different industries and business sizes.

The cost of cyber insurance premiums varies depending on the type and size of the business insured. Annual premiums for Smart Cyber Insurance® start at around $2,000.

Premiums vary depending on the type and size of the business insured. Annual premiums for Smart Tech E&O® insurance start at around $3,000.

Corvus considers several factors when calculating premiums and underwriting cyber insurance, including the applicant’s score on our non-invasive IT security scan, the applicant’s revenue and nature of business, the quality of the applicant's cybersecurity controls, and the limit requested.

The first step toward submitting a cyber insurance application with Corvus is to get appointed with us.

If you are already appointed to work with our team, you can either email us directly at [email protected] or reach out to your local Territory Manager to begin your submission.

Corvus territory managers:

Jim Lannon - Northeast

Assistant Vice President, Distribution

[email protected]

Allie Greenberger - Mid-West / Texas

Manager, Central National Accounts

[email protected]

Preston Way - West Coast

Territory Assistant Vice President

[email protected]

Christy Johnson - Southeast

Territory Assistant Vice President

[email protected]